Deciding between a Gold IRA and physical gold can feel overwhelming. Both offer distinct advantages, making the "best" choice highly specific to your retirement planning. A Gold IRA|Precious Metals IRA provides diversification, allowing your assets to potentially grow over time within a protected framework. Conversely, physical gold offers tangible possession, providing a sense of stability.

- Think about your investment horizon carefully.

- Determine if you prioritize growth potential.

- Investigate reputable providers for both options.

Finally, the optimal choice depends on your unique circumstances. Consulting a qualified financial advisor can provide invaluable guidance tailored to your specific situation.

Gold IRA vs. 401(k) – The Ultimate Retirement Comparison

Planning for retirement can be a complex journey, during many decisions to make along the way. Two popular choices often considered are the Gold IRA and the traditional 401(k). Each offers unique advantages, presenting investors with a crucial decision. A Gold IRA invests in physical gold, offering a potential hedge against inflation and market volatility. Conversely, a 401(k) is a retirement savings plan sponsored by employers, often featuring employer contributions or tax benefits.

- When choosing between these two options, it's essential to consider your investment goals, risk tolerance, and existing financial situation.

- Understanding the differences between a Gold IRA and a 401(k) is key to making an informed decision that aligns with your long-term retirement aspirations.

Finally, the best choice for you will depend on your individual needs and circumstances. Consulting with a qualified financial advisor can provide valuable assistance in navigating this decision and developing a retirement plan that meets your specific requirements.

Unlocking the Potential: Gold IRA Pros and Cons

When exploring retirement savings, a Gold IRA can look like an appealing option. It presents the opportunity for protection your wealth against economic downturns, but it's crucial to meticulously consider both the advantages and challenges. One key advantage of a Gold IRA is its ability to hedge against inflation, as gold has historically held its value over time. Additionally, individuals can allocate their portfolios by adding precious metals like gold, potentially reducing overall risk. However, Gold IRAs also come with certain considerations. The initial investment can be significant, and there are annual charges associated with administration. Moreover, readily available funds can be more restricted compared to traditional IRAs.

- Moreover, it's important to consult a qualified financial advisor before making any selections regarding your retirement arrangement.

Top-Rated Gold IRAs

Are you interested in diversifying your retirement portfolio with precious metals? A Gold IRA might be the perfect choice for you. These accounts allow you to invest in physical gold, platinum, and other valuable metals, potentially offering safety against market volatility. But with so many providers out there, choosing the right Gold IRA can be challenging. That's where our expert reviews come in. We've thoroughly examined some of the top-rated Gold IRA companies based on factors like fees, Gold IRA vs physical gold customer service, and investment options.

Our comprehensive reviews will provide you with the knowledge you need to make an informed selection. We'll compare different Gold IRA providers, highlighting their strengths and limitations. Whether you're a seasoned investor or just starting out, our guide will help you find the perfect Gold IRA to fulfill your needs.

- Uncover the leading Gold IRA companies in the industry.

- Compare fees, customer service, and investment options to find the best fit for you.

- Acquire insights from expert reviews and suggestions on choosing a Gold IRA.

Do a Gold IRA the Best Move for Your Retirement Portfolio?

When crafting your retirement portfolio, it's essential to analyze various financial options. A Gold IRA presents itself as a potentially interesting choice for many investors seeking diversification against economic volatility. However, it's crucial to thoroughly examine the pros and cons before diving into this type of strategy.

- Weigh the possible return on investment against the expenses associated with a Gold IRA.

- Research the existing gold market trends and forecast future outlook.

- Consult a financial advisor to determine if a Gold IRA suits your overall aspirations.

Unlocking Prosperity: A Comprehensive Guide to Gold IRAs

Are you about protecting your financial well-being? A Precious Metal IRA could be the solution you've been searching for. These accounts allow people like you to invest in physical gold, a historically reliable asset that can serve as a buffer against inflation. A Gold IRA offers various advantages, including:

- Spread of Risk

- Potential for Tax Savings

- Protection Against Rising Costs

Nevertheless, picking a reputable Custodian is crucial. Conduct thorough investigate different choices and compare their fees, offerings, and track record.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Robbie Rist Then & Now!

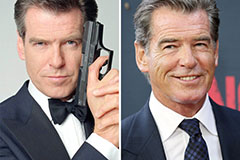

Robbie Rist Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!